|

|

||||||||||

|

Volume

75

|

A small green jacket, old and torn but clean and pressed, hangs in the closet of Tung “Tom” Ngo ’89C, founder and CEO of Focus Investments, a one-man money management firm with a $14 million portfolio. It is the jacket Ngo wore for seven days in 1982 as he and nine strangers motored across the South China Sea on an escape voyage from the Communist regime in Vietnam. Ngo keeps the jacket as a reminder of how far he has come.

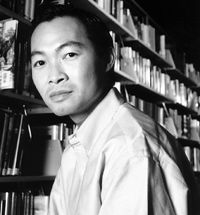

“I was so far behind when I finally got to America,” says the thirty-four-year-old Ngo. “I knew I had only so long to catch up. This is a winner-take-all society. If I relax, I waste time.” Ngo has wasted no time since that boat trip landed him in a refugee camp in Malaysia, where he studied English while seeking political asylum in the United States. He came to Atlanta in 1983 and earned an economics degree at Emory in 1989. He began his investment career with Prudential Securities on Wall Street, later returning to Atlanta and joining Robinson-Humphrey. In 1995, he became a free agent. Regarding his company’s success, Ngo lets the numbers speak for themselves. In less than five years, the company’s portfolio has had a cumulative return of 187 percent. In 1999, he earned a thirty-eight percent return for his clients. His simple investment philosophy (“look for staying power”) echoes the buy-and-hold strategy of Warren Buffet of Berkshire Hathaway, the financial guru whom Ngo emulates. His average work week is sixty-five hours, including Saturdays, when he visits what he calls “America’s gold mine”–the public library–and reads corporate annual reports from opening to closing time. Every day, he makes a to-do list with ten goals, and he aims for an efficiency rating of seventy percent. To relax, he swims a mile a day. Why so driven? “It’s worth it to be the best,” he says. “It’s always worth it to be the best.” –Sharla A. Paul |

|||||